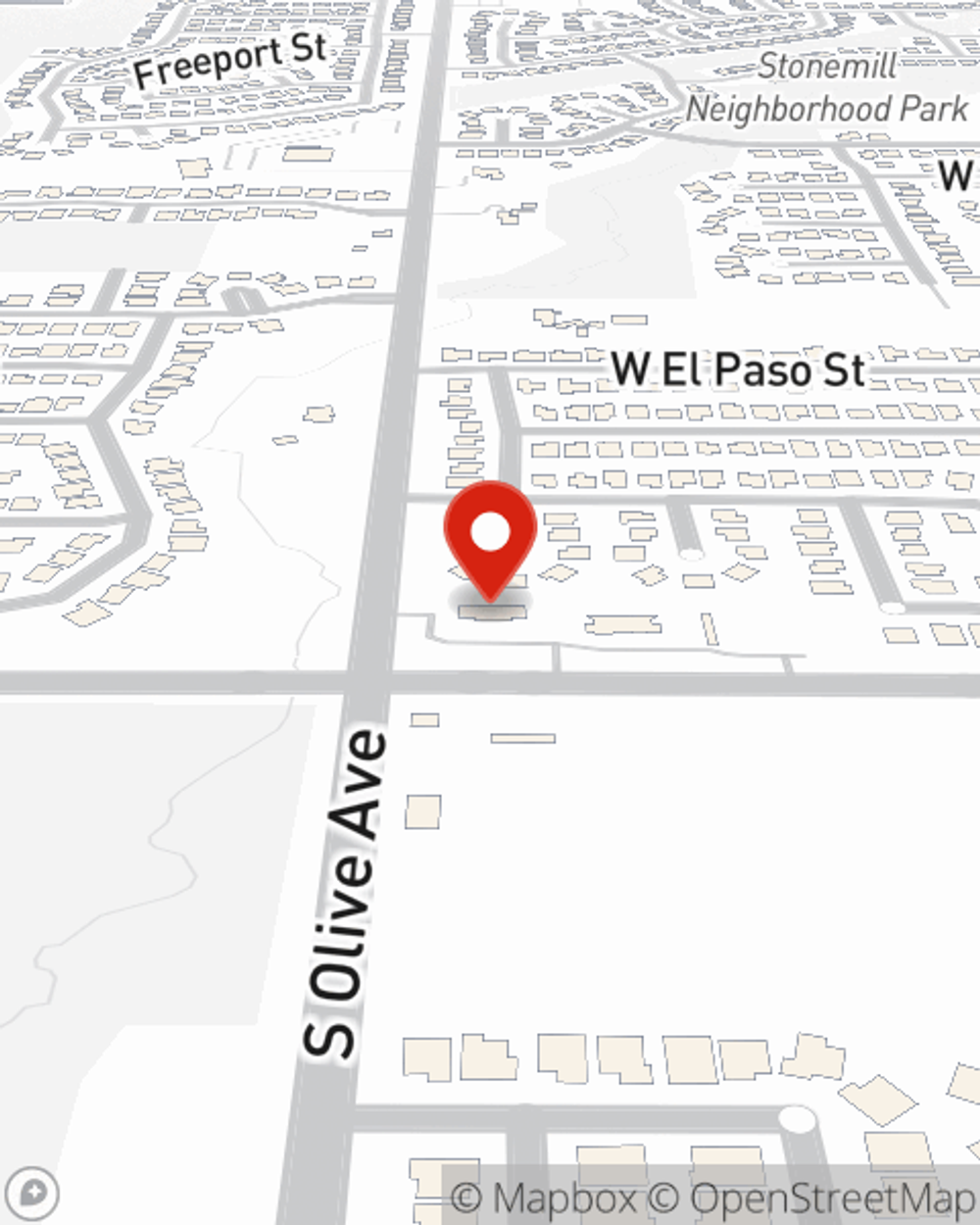

Business Insurance in and around Broken Arrow

Broken Arrow! Look no further for small business insurance.

Cover all the bases for your small business

- Tulsa

- Jenks

- Bixby

Insure The Business You've Built.

Running a business is about more than being your own boss. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for the ones you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, errors and omissions liability and extra liability coverage.

Broken Arrow! Look no further for small business insurance.

Cover all the bases for your small business

Protect Your Future With State Farm

When you've put so much personal interest in a small business like yours, whether it's a clock shop, a yogurt shop, or an art gallery, having the right coverage for you is important. As a business owner, as well, State Farm agent Brittanie Portillo McCoy understands and is happy to help with customizing your policy options to fit the needs of you and your business.

Call Brittanie Portillo McCoy today, and let's get down to business.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Brittanie Portillo McCoy

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.